282 Calgary Trail NW, Edmonton, Alberta

P: 780-439-7000

F: 866-293-5424

Monday, July 11, 2011 - Preferred Market Interpretation - June 2011

Edmonton, Alberta Real Estate Market Update for June 2011

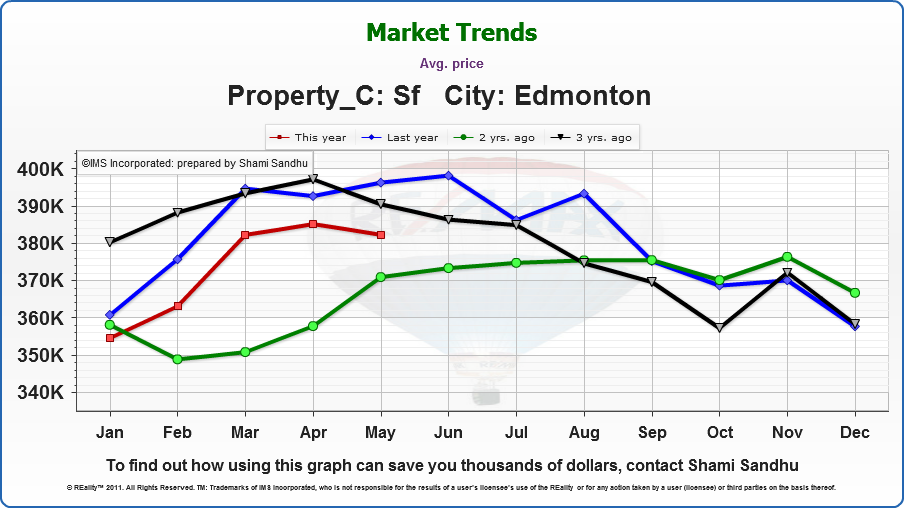

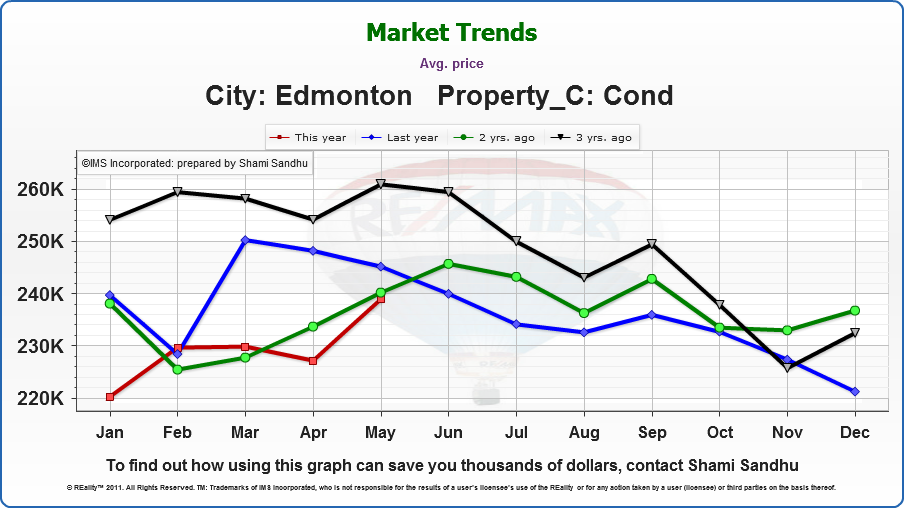

Inventory high—great selection for buyers, but expect average price drops in fall

What should you do? Where are the opportunities?

Now is a great time to buy. With plenty of choice, currently low interest rates that are planned to increase by fall, and more motivated sellers into the fall, if you are looking for your first home, moving up, or an investment property, now is the time!

Seller’s looking to maximize their equity, should likely wait until Feb/Mar of 2012 to place their property on the market. Except if you are looking at moving up in price and home size, then now’s the time. August will be the absolute latest you’ll want to have your property on the market, so call us today!

| Average House Price | Average Condo Price |

|

|

REALTORS Association of Edmonton - Market Report (June 2011)

|

Edmonton, July 5, 2011: Economic and other external indicators point to a strengthening of the local real estate market according to the REALTORS® Association of Edmonton. |

- Statistics Canada reported that Alberta boasted the highest spike in population in the first quarter with a 0.4% increase.

- The Conference Board of Canada predicts that housing prices in Edmonton will increase from five to seven percent in the short term although local prices are currently down when compared to last year.

- Although the Bank of Canada seems reluctant to raise interest rates because of the negative impact on exports, CMHC reports that Canadians are budgeting for an interest rate hike.

- While housing prices nationally are up by 8.6% (May figures) Edmonton prices are tracking predictably in a stable market.

- CIBC is of the opinion that Alberta home prices are over-valued by 17% yet RBC names Edmonton amongst the most affordable major metro markets in Canada.

- A report by Peters and Co. forecast that $180 billion will be spent on new oilsands projects in the next decade with current oilsands operations and maintenance adding another $30 billion a year.

“The various reports and indicators can be confusing and contradictory,” said REALTORS® Association of Edmonton President Chris Mooney. “Alberta and Edmonton are often moving in a different direction than the rest of the country and a national statistic or trend may not apply here. REALTORS® are very optimistic about the current market and are prepared to help home buyers and sellers sort through the figures to determine the best housing strategy for each individual or family.”

In the first half of the year the average* price of a single family detached home has risen from $357,540 to $379,409 while the all-residential price has risen from $308,497 to $330,297. However compared to the same-month year-over-year, prices have risen consistently between the levels set in the past two years.

In the short term, when compared to the previous month, prices in June were generally stable. Single family homes were up 0.31% from $378,239 to $379,409. Condo prices dropped from $239,782 to $231,852 (down 3.3% after rising 3.1% in May). Duplex and row house prices climbed slightly from $295,334 to $296,689. The all-residential average price dipped 0.5% during the month of June.

There were 1,768 residential sales in June with 3,260 listings resulting in a sales-to-listing ratio of 54%. This is compared to 53% in May. There are currently 8,432 residential properties in the MLS® System inventory and days-on-market is slower at 53 days (up from 50 in May).

“We know that all real estate is local and homeowners and buyers should focus on local data and local expertise to guide their decisions,” said Mooney. “Is it a good time to buy a home in Edmonton? If your domestic needs have changed and you need to move, then seek professional advice and start the process.”

Archives

Categories