282 Calgary Trail NW, Edmonton, Alberta

P: 780-439-7000

F: 866-293-5424

Saturday, February 26, 2011 - Oil tops $100... good or bad?

Oil tops $100...

This is a double edged sword, but as global energy demand grows, and political turmoil continues, Alberta is becoming THE source for sustainable oil. With higher oil prices come new jobs, salary increases, capital investment, and that leads to a strong real estate market.

Article from CNNMoney.com here...

What does this mean to Alberta and to Edmonton's Real Estate Market?

Don't expect to see immediate impact, even within a year. The impact of oil is felt over the longer term, and prices must remain at higher levels for a duration to create company profits in oil companies before they will re-invest that profit. Most new development is cash flow funded, and either way the financial viability of it requires long term perspective and planning.

What about natural gas?

We can't forget about natural gas either. For Alberta, natural gas has the largest impact on government royalties income, and has a more immediate impact on growth in the province. Natural gas prices have not increased at the same rates, and must in order to see consistent growth in economy in Alberta.

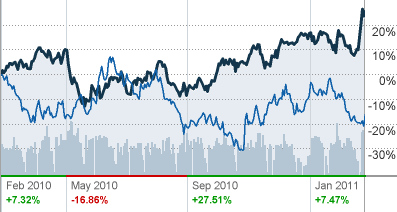

See the chart below for Crude light oil prices compared to Natural Gas prices percentage change over the past 1 year

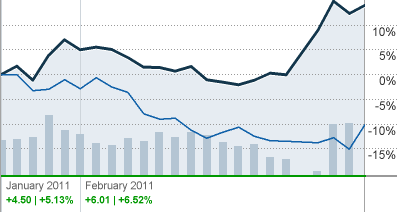

Now compare to the recent 1 month period

Alberta is poised as the most economically sound, resource based, economy in North America to rebound in economy and real estate values. But we need to keep in perspective and be aware of ALL factors that influence growth and especially that lead to real estate value increases. We first need to see demand for labour unmet by current low unemployment. Then net in migration population growth, leading to increased demand for rental housing. This makes those who invest in real estate now look like geniuses when their rents rise over the next few years, and property values rise as well as the affordability index makes sense for people to pay more to purchase a home than what they are paying for rent. And as demand for housing increases and supply of new construction lags to catch up, and inventory levels of resale housing return to under 5,000 listings in Edmonton, we will see property values increasing steadily again.

These elements WILL happen, but it is a matter of time. Our prediction is likely another 2-3 years yet, but that the best time to buy property is now when motivated vendors can be found that create great buys. Whether it's for an investment property, or a home for yourself - it's the best investment you can make!

Archives

Categories